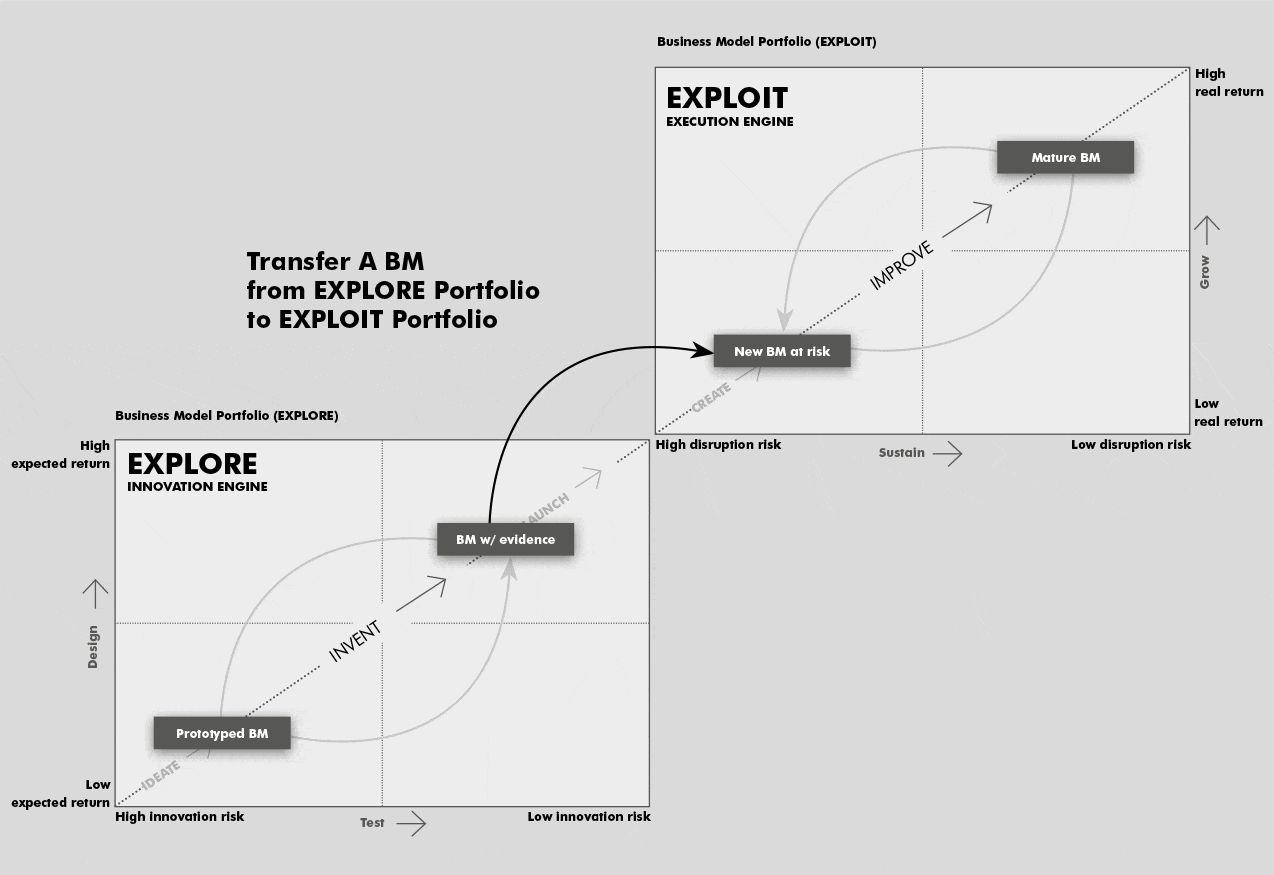

We have prototyped a new tool called the Business Portfolio Map. The aim: to help organizations understand if the business is prepared for the future or risks disruption.

The Business Portfolio Map visualizes a company’s entire portfolio of business models on a single map. In the image above you can see the full concept which is composed of the execution engine (exploit/improve) and the innovation engine (explore/invent). The Business Portfolio Map visualises all of your existing businesses, as well as all of your new growth initiatives. This holistic view shows you if your company is prone to disruption, at risk, or if you are prepared for the future. More importantly, the Business Portfolio Map can help companies make better investment decisions.

Let’s walk through how the Business Portfolio Map works.

This is where you manage your existing businesses. In your business portfolio, you hope to keep all your businesses highly profitable and sustainable at the top right of the exploit Map. In our prototype, Yves and I visualize the portfolio of existing businesses on two axis:

Businesses that fall from the top right down to the left are dying or sick businesses that you need to take care of. It may not necessarily mean you kill those businesses – that may be an option, but ultimately it’s about renovating, improving and sometimes reinventing the business and moving it up to the top right hand corner.

Businesses that fall from the top right down to the left are dying or sick businesses that you need to take care of. It may not necessarily mean you kill those businesses – that may be an option, but ultimately it’s about renovating, improving and sometimes reinventing the business and moving it up to the top right hand corner.

New businesses that graduate from the Innovation Engine to the Execution Engine usually start out at the bottom left. They are still very fragile, barely profitable, and need a lot of care. Your goal is also to move them up to the top right hand corner.

Ultimately, a healthy Execution Portfolio has a good number of businesses at the top right, a number of young new businesses at the bottom left, and as few as possible anywhere else.

When it comes to the Innovation Engine, you want to explore many, many different ideas. New business models and initiatives will start out at the bottom left of the map: their profit potential is unclear and you have little evidence to prove that the idea is likely to work. You have to iteratively design, test, and adapt the idea, its value propositions, and business models until it makes it to the top right hand corner: a tested business idea with substantial profit potential.

To visualize the portfolio of potential new businesses we use two axis, similar to the business model portfolio of existing businesses:

The particularity of the Innovation Engine is that you need a lot of cheap projects at the bottom left in order to product a winner that makes it to the top right. You need to explore, prototype, and test many ideas cheaply and quickly to learn and adapt. The investment at this stage isn’t big. The more evidence you gather that an idea might work, the more you invest and start to move the idea up towards the right. Out of ten ideas maybe five will die, three will remain mediocre, and two will be home runs.

Be careful not to push promising ideas from the Innovation Engine into the execution space too quickly. These young businesses need traction, stability, and protection when you move them into the execution engine. They might get swallowed up by the execution engine or killed by the dominant business models’ antibodies – it’s a corporate habit that can kill your innovation engine.

The Business Portfolio Map visualizes how prepared your organization is for the future. You have an obvious challenge if you have only a few businesses at the top right in the execution engine, and a lot of business at risk with low returns. You have an even bigger challenge when your innovation engine shows few new promising and validated future growth engines in the pipeline.

The ultimate goal of a balanced Business Portfolio Map is to show good, solid business models at the top right, and a lot of fresh new ideas at the bottom left. A few of those ideas should be creeping up to the top right of the explore square and soon make it to the Execution Engine. If you can visualize that for your business then you can say you’re prepared for the future.

Amazon is an example we frequently cite of a company that intentionally manages a diverse portfolio of existing and promising new business models. The company continues to produce growth with its existing businesses (e-commerce, AWS, logistics, etc.), while juggling a portfolio of potential future growth engines that may become big profit generators one day (e.g. Alexa, Echo, Dash Button, Prime Air, Amazon Fresh, Mayday Button, etc.).

We put together three steps to get started with the Business Portfolio Map:

This is an excerpt from Strategy@Work, a Brightline and Thinkers50 collaboration bringing together the very best thinking and insights in the field of strategy and beyond.

Osterwalder and Pigneur are the authors of Value Proposition Design: How to Create Products and Services Customers Want (2014) and Business Model Generation: A Handbook for Visionaries, Gamechangers and Challengers (self-published, 2010). Business Model Generation is based on a tool called the Business Model Canvas. The book’s contents were co-created by 470 Business Model Canvas practitioners from 45 countries, and features a highly visual, four-colour design that explains a range of strategic ideas and tools.

Thinkers50 Limited

The Studio

Highfield Lane

Wargrave RG10 8PZ

United Kingdom

Thinkers50 Limited

The Studio

Highfield Lane

Wargrave RG10 8PZ

United Kingdom

| Cookie | Duration | Description |

|---|---|---|

| LANG | 9 hours | Linkedin set this cookie to set user's preferred language. |

| nsid | session | This cookie is set by the provider PayPal to enable the PayPal payment service in the website. |

| sp_landing | 1 day | The sp_landing is set by Spotify to implement audio content from Spotify on the website and also registers information on user interaction related to the audio content. |

| sp_t | 1 year | The sp_t cookie is set by Spotify to implement audio content from Spotify on the website and also registers information on user interaction related to the audio content. |

| tsrce | 3 days | PayPal sets this cookie to enable the PayPal payment service in the website. |

| x-pp-s | session | PayPal sets this cookie to process payments on the site. |

| __cf_bm | 30 minutes | This cookie, set by Cloudflare, is used to support Cloudflare Bot Management. |

| Cookie | Duration | Description |

|---|---|---|

| l7_az | 30 minutes | This cookie is necessary for the PayPal login-function on the website. |

| Cookie | Duration | Description |

|---|---|---|

| CONSENT | 2 years | YouTube sets this cookie via embedded youtube-videos and registers anonymous statistical data. |

| _ga | 2 years | The _ga cookie, installed by Google Analytics, calculates visitor, session and campaign data and also keeps track of site usage for the site's analytics report. The cookie stores information anonymously and assigns a randomly generated number to recognize unique visitors. |

| _gat_gtag_UA_10408481_1 | 1 minute | Set by Google to distinguish users. |

| _ga_ZP8HQ8RZXS | 2 years | This cookie is installed by Google Analytics. |

| _gid | 1 day | Installed by Google Analytics, _gid cookie stores information on how visitors use a website, while also creating an analytics report of the website's performance. Some of the data that are collected include the number of visitors, their source, and the pages they visit anonymously. |

| Cookie | Duration | Description |

|---|---|---|

| NID | 6 months | NID cookie, set by Google, is used for advertising purposes; to limit the number of times the user sees an ad, to mute unwanted ads, and to measure the effectiveness of ads. |

| test_cookie | 15 minutes | The test_cookie is set by doubleclick.net and is used to determine if the user's browser supports cookies. |

| VISITOR_INFO1_LIVE | 5 months 27 days | A cookie set by YouTube to measure bandwidth that determines whether the user gets the new or old player interface. |

| YSC | session | YSC cookie is set by Youtube and is used to track the views of embedded videos on Youtube pages. |

| yt-remote-connected-devices | never | YouTube sets this cookie to store the video preferences of the user using embedded YouTube video. |

| yt-remote-device-id | never | YouTube sets this cookie to store the video preferences of the user using embedded YouTube video. |

| yt.innertube::nextId | never | This cookie, set by YouTube, registers a unique ID to store data on what videos from YouTube the user has seen. |

| yt.innertube::requests | never | This cookie, set by YouTube, registers a unique ID to store data on what videos from YouTube the user has seen. |

| Cookie | Duration | Description |

|---|---|---|

| DEVICE_INFO | 5 months 27 days | No description |

| loglevel | never | No description available. |

| m | 2 years | No description available. |

Thinkers50 Limited has updated its Privacy Policy on 28 March 2024 with several amendments and additions to the previous version, to fully incorporate to the text information required by current applicable date protection regulation. Processing of the personal data of Thinkers50’s customers, potential customers and other stakeholders has not been changed essentially, but the texts have been clarified and amended to give more detailed information of the processing activities.