Oscar Wilde is credited with the quote “The cynic knows the price of everything and the value of nothing”. And some say this is a reflection of the mental model of most financial executives.

To be successful any company requires assets. These range from cash to securities and from tangible fixed assets to goodwill. At a more granular level, they are divided into two main types of assets: current assets and non-current assets. These classifications are used to aggregate assets into different blocks on the balance sheet, so that the relative liquidity of the assets of a company can be discerned.

However tried-and-true the financial-accounting system is, it’s overlooking an important aspect of the value creation process. None of the financial recognized assets can create customer value (which in term drive profitability) without human intervention. Take for example, the 3D printer in an innovation lab. It is likely listed in the company’s books under tangible fixed asset. But, by itself, the printer can’t create anything of value. The printer requires a human to design a prototype, of what can later be the company’s next flagship product. The same story can be replicated for every other financial recognized asset.

The big issue at hand is that the financial-accounting system is recording under OPEX the human resource element and the time/process of creating customer value from accounting recognized assets. So basically, from a CFO’s perspective all the employees are liabilities. Fact that’s flying in the face of the popular ‘people are our greatest assets’ aphorism.

Proof that executives live by the financial account system and not by the ‘people are our greatest assets’ cliche is that when cost cutting is required, the first action is to lay off staff, cut wages or reduce spending on training.

By classifying employees (culture and processes) as assets, it would then be in the company’s best interest to try to increase the value of these assets. This can be done by the company investing time and money, through training, mentoring, developing and improving. If the employees feel valued their sense of job satisfaction will increase. The benefit to the employer is a more committed workforce, lower absenteeism, lower staff turnover and better qualified staff, all leading to higher productivity.

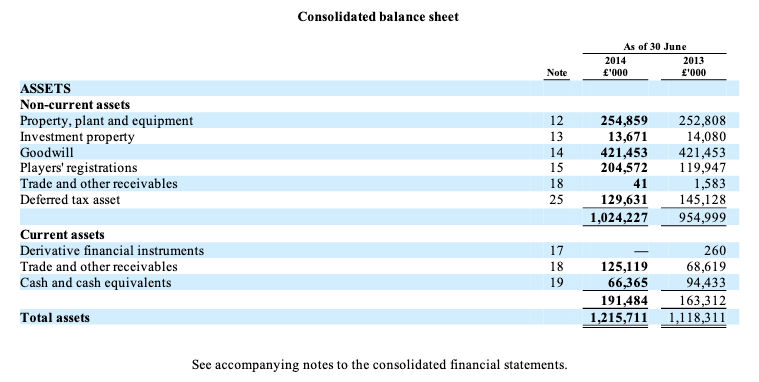

There are however blue chip organizations out there listing and treating their people as assets. These organizations are professional football clubs. An analysis of Manchester United PLC’s (Public Limited Company) annual report submitted to the New York Stock Exchange paints a clear picture as to how players are treated in accounting terms and how they are shown as assets in the balance sheet.

From the report, it can be inferred that the accounting treatment for player registrations is in no way different from any other capital asset. The cost of acquisition of a player is amortized over the period of his contract through the straight-line method.

It’s not realistic to hope now that banks, for example, will start treating employees as football clubs treat their players. But there’s one thing that CFOs can start doing. They can look into the financial accounting documents and identify strategic resources. These strategic resources will than be nurtured and developed as the financial assets are. According to Professor Bruch Lev a strategic resource has the following attributes:

– they contribute directly the value creation process. For example they file patents or create new products and services.

– they are scarce or limited. For example a telecommunication 5G license, a certain airport landing rights or a banking license.

– they are difficult to replicate or imitate. Competitors are not able to easily imitate or copy them. For example Apple’s AppStore or Zappo’s customer service culture.

Enterprises operating effectively their strategic resources are able to consistently stay ahead of the game. Making their present and future competitors constantly play catchup. Hence gaining a sustained competitive advantage.

Dan Toma is co-author of The Corporate Startup (published by Vakmedien in 2017 and awarded ‘Management Book of the Year for Innovation and Entrepreneurship’ by the Chartered Management Institute and The British Library in 2018).

Dan Toma is co-author of The Corporate Startup (published by Vakmedien in 2017 and awarded ‘Management Book of the Year for Innovation and Entrepreneurship’ by the Chartered Management Institute and The British Library in 2018).

He started his career in entrepreneurship, being involved with technology startups across the world. Puzzled by the questions ‘why are innovative products mainly launched by startups?’, he focuses on enterprise innovation strategy – specifically on the changes blue-chip organizations need to make to allow for new ventures to be built in a corporate setting. He has worked with organizations worldwide including Deutsche Telekom, Bosch, Jaguar Land Rover, Bayer, John Deere and Allianz.

Thinkers50 Limited

The Studio

Highfield Lane

Wargrave RG10 8PZ

United Kingdom

Thinkers50 Limited

The Studio

Highfield Lane

Wargrave RG10 8PZ

United Kingdom

Thinkers50 Limited

The Studio

Highfield Lane

Wargrave RG10 8PZ

United Kingdom

| Cookie | Duration | Description |

|---|---|---|

| LANG | 9 hours | Linkedin set this cookie to set user's preferred language. |

| nsid | session | This cookie is set by the provider PayPal to enable the PayPal payment service in the website. |

| sp_landing | 1 day | The sp_landing is set by Spotify to implement audio content from Spotify on the website and also registers information on user interaction related to the audio content. |

| sp_t | 1 year | The sp_t cookie is set by Spotify to implement audio content from Spotify on the website and also registers information on user interaction related to the audio content. |

| tsrce | 3 days | PayPal sets this cookie to enable the PayPal payment service in the website. |

| x-pp-s | session | PayPal sets this cookie to process payments on the site. |

| __cf_bm | 30 minutes | This cookie, set by Cloudflare, is used to support Cloudflare Bot Management. |

| Cookie | Duration | Description |

|---|---|---|

| l7_az | 30 minutes | This cookie is necessary for the PayPal login-function on the website. |

| Cookie | Duration | Description |

|---|---|---|

| CONSENT | 2 years | YouTube sets this cookie via embedded youtube-videos and registers anonymous statistical data. |

| _ga | 2 years | The _ga cookie, installed by Google Analytics, calculates visitor, session and campaign data and also keeps track of site usage for the site's analytics report. The cookie stores information anonymously and assigns a randomly generated number to recognize unique visitors. |

| _gat_gtag_UA_10408481_1 | 1 minute | Set by Google to distinguish users. |

| _ga_ZP8HQ8RZXS | 2 years | This cookie is installed by Google Analytics. |

| _gid | 1 day | Installed by Google Analytics, _gid cookie stores information on how visitors use a website, while also creating an analytics report of the website's performance. Some of the data that are collected include the number of visitors, their source, and the pages they visit anonymously. |

| Cookie | Duration | Description |

|---|---|---|

| NID | 6 months | NID cookie, set by Google, is used for advertising purposes; to limit the number of times the user sees an ad, to mute unwanted ads, and to measure the effectiveness of ads. |

| test_cookie | 15 minutes | The test_cookie is set by doubleclick.net and is used to determine if the user's browser supports cookies. |

| VISITOR_INFO1_LIVE | 5 months 27 days | A cookie set by YouTube to measure bandwidth that determines whether the user gets the new or old player interface. |

| YSC | session | YSC cookie is set by Youtube and is used to track the views of embedded videos on Youtube pages. |

| yt-remote-connected-devices | never | YouTube sets this cookie to store the video preferences of the user using embedded YouTube video. |

| yt-remote-device-id | never | YouTube sets this cookie to store the video preferences of the user using embedded YouTube video. |

| yt.innertube::nextId | never | This cookie, set by YouTube, registers a unique ID to store data on what videos from YouTube the user has seen. |

| yt.innertube::requests | never | This cookie, set by YouTube, registers a unique ID to store data on what videos from YouTube the user has seen. |

| Cookie | Duration | Description |

|---|---|---|

| DEVICE_INFO | 5 months 27 days | No description |

| loglevel | never | No description available. |

| m | 2 years | No description available. |

Thinkers50 Limited has updated its Privacy Policy on 28 March 2024 with several amendments and additions to the previous version, to fully incorporate to the text information required by current applicable date protection regulation. Processing of the personal data of Thinkers50’s customers, potential customers and other stakeholders has not been changed essentially, but the texts have been clarified and amended to give more detailed information of the processing activities.