Virtual Event

Sydney Finkelstein – ranked #43 in the Thinkers 50 2013 rankings – has released his “Best and Worst CEOs of 2014”.

Since 2010, Finkelstein has shared with the public the CEOs he believes have made the biggest gaffes and who are leading companies with significant financial struggles.

“People often say they learn from their mistakes,” he says. “Drawing attention to prominent CEOs who have stumbled is another way to learn, for all of us, about what works and doesn’t when it comes to leadership.”

Beginning last year, in conjunction with his worst CEOs list, Finkelstein started recognizing CEOs he deems the best based on company performance and the link between that company’s success and the CEO’s strategy and leadership.

#5 Dick Costolo, CEO, Twitter: With shares at Twitter dropping by 42 percent and monthly active users (MAU) slowing, Finkelstein says Twitter is not fulfilling its huge potential, growing more slowly and with more question marks under CEO Costolo.

#4 Eddie Lampert, CEO, Sears Holdings: Sears continues to book half-billion-dollar quarterly losses. Finkelstein cites Lampert’s failed strategy, arrogant leadership, and Sears’ rapidly dropping stock price as reasons for his place on this year’s worst CEOs list. This is the second consecutive year Lampert has been named one of Finkelstein’s worst CEOs.

#3 Philip Clarke, CEO, Tesco (with honorable mention to his predecessor as CEO, Terry Leahy): After what Finkelstein calls a disastrous year for Tesco, Clarke was fired on July 21, 2014. The company’s U.S. venture, Fresh & Easy, was long-time CEO Terry Leahy’s mistake, says Finkelstein, costing the company $2.7 billion. However, Clarke took one year to close a business that continued to hemorrhage money, he says.

#2: Dov Charney, CEO, American Apparel: In addition to several company scandals, alleged financial misconduct, and numerous lawsuits filed against American Apparel and Charney, Finkelstein also cites the company’s stock price, which is down 80 percent in five years, as one of several reasons Charney is the #2 worst CEO of 2014.

#1: Ricardo Espírito Santo Silva Salgado: CEO, Banco Espírito Santo (BES): Finkelstein’s worst CEO of the year goes to the head of the Salgado family of Portugal—the CEO who controlled the second-biggest bank in Portugal, and brought it to bankruptcy. During the first half of 2014, BES saw a loss of $4.5 billion. Finkelstein also cites allegations of fraud, complicated intertwining ownership stakes among family-controlled enterprises, and the fact that Portugal was forced to bail out BES with $6 billion as reasons why Salgado is the #1 worst CEO of 2014.

#5: Andrew Wilson, CEO, Electronic Arts: In 2012 and 2013, Electronic Arts was named the “Worst Company in America” by Consumerist. Today, its stock price is up 96 percent, which Finkelstein calls “incredible.”

#4: John Martin, CEO, Gilead Sciences: Finkelstein says Martin “successfully brought Sovaldi to market and embraced a pricing strategy that delivered significant value to investors.”

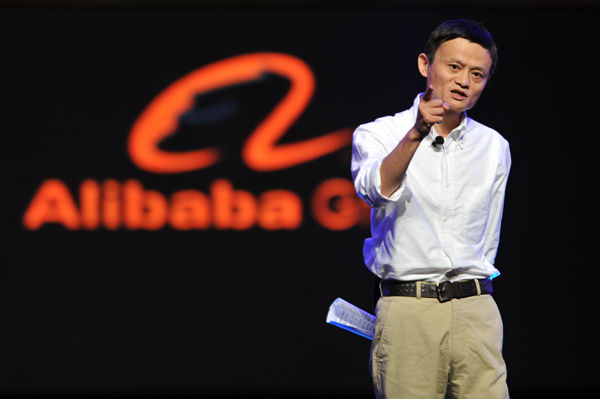

#3: Jack Ma, CEO, Alibaba: After the largest IPO in history, which raised $25 billion in September, Alibaba has succeeded in growing its stock price an additional 12 percent since its IPO. Finkelstein credits Jack Ma with Alibaba’s significant growth—its total revenue grew by 53.7 percent to $2.74 billion in 2014 with mobile revenue growing by more than 1,000 percent.

#2: Kevin Plank, CEO, Under Armour: Under Armour’s stock price rose 58 percent, after an incredible 80-percent gain last year. Under Armour has now had four straight quarters of over 30-percent growth and 18 straight quarters of over 20-percent growth. “Nike,” says Finkelstein, “is on alert.”

#1: Elon Musk, CEO, Tesla and CEO, SpaceX: “2014 was an impressive year for Elon Musk as he led two companies on big growth trajectories,” says Finkelstein. “In addition to Tesla’s stock price increasing 38 percent year to date after rising 344 percent in 2013, SpaceX made a number of successful trips to space and won important government contracts.”

Thinkers50 Limited

The Studio

Highfield Lane

Wargrave RG10 8PZ

United Kingdom

Thinkers50 Limited

The Studio

Highfield Lane

Wargrave RG10 8PZ

United Kingdom

Thinkers50 Limited

The Studio

Highfield Lane

Wargrave RG10 8PZ

United Kingdom

| Cookie | Duration | Description |

|---|---|---|

| LANG | 9 hours | Linkedin set this cookie to set user's preferred language. |

| nsid | session | This cookie is set by the provider PayPal to enable the PayPal payment service in the website. |

| sp_landing | 1 day | The sp_landing is set by Spotify to implement audio content from Spotify on the website and also registers information on user interaction related to the audio content. |

| sp_t | 1 year | The sp_t cookie is set by Spotify to implement audio content from Spotify on the website and also registers information on user interaction related to the audio content. |

| tsrce | 3 days | PayPal sets this cookie to enable the PayPal payment service in the website. |

| x-pp-s | session | PayPal sets this cookie to process payments on the site. |

| __cf_bm | 30 minutes | This cookie, set by Cloudflare, is used to support Cloudflare Bot Management. |

| Cookie | Duration | Description |

|---|---|---|

| l7_az | 30 minutes | This cookie is necessary for the PayPal login-function on the website. |

| Cookie | Duration | Description |

|---|---|---|

| CONSENT | 2 years | YouTube sets this cookie via embedded youtube-videos and registers anonymous statistical data. |

| _ga | 2 years | The _ga cookie, installed by Google Analytics, calculates visitor, session and campaign data and also keeps track of site usage for the site's analytics report. The cookie stores information anonymously and assigns a randomly generated number to recognize unique visitors. |

| _gat_gtag_UA_10408481_1 | 1 minute | Set by Google to distinguish users. |

| _ga_ZP8HQ8RZXS | 2 years | This cookie is installed by Google Analytics. |

| _gid | 1 day | Installed by Google Analytics, _gid cookie stores information on how visitors use a website, while also creating an analytics report of the website's performance. Some of the data that are collected include the number of visitors, their source, and the pages they visit anonymously. |

| Cookie | Duration | Description |

|---|---|---|

| NID | 6 months | NID cookie, set by Google, is used for advertising purposes; to limit the number of times the user sees an ad, to mute unwanted ads, and to measure the effectiveness of ads. |

| test_cookie | 15 minutes | The test_cookie is set by doubleclick.net and is used to determine if the user's browser supports cookies. |

| VISITOR_INFO1_LIVE | 5 months 27 days | A cookie set by YouTube to measure bandwidth that determines whether the user gets the new or old player interface. |

| YSC | session | YSC cookie is set by Youtube and is used to track the views of embedded videos on Youtube pages. |

| yt-remote-connected-devices | never | YouTube sets this cookie to store the video preferences of the user using embedded YouTube video. |

| yt-remote-device-id | never | YouTube sets this cookie to store the video preferences of the user using embedded YouTube video. |

| yt.innertube::nextId | never | This cookie, set by YouTube, registers a unique ID to store data on what videos from YouTube the user has seen. |

| yt.innertube::requests | never | This cookie, set by YouTube, registers a unique ID to store data on what videos from YouTube the user has seen. |

| Cookie | Duration | Description |

|---|---|---|

| DEVICE_INFO | 5 months 27 days | No description |

| loglevel | never | No description available. |

| m | 2 years | No description available. |

Thinkers50 Limited has updated its Privacy Policy on 28 March 2024 with several amendments and additions to the previous version, to fully incorporate to the text information required by current applicable date protection regulation. Processing of the personal data of Thinkers50’s customers, potential customers and other stakeholders has not been changed essentially, but the texts have been clarified and amended to give more detailed information of the processing activities.