Virtual Event

By Anil K. Gupta & Haiyan Wang

This article originally appeared in Duke CE’s Dialogue Magazine.

Think back to what the world was like 25 years ago. In 1998, China was just starting to build its infrastructure. President Jiang Zemin and Premier Zhu Rongji were busy dismantling state-owned enterprises and embracing the logic of the market. Boris Yeltsin was President of Russia, keen to integrate his country with the rest of the world. The World Trade Organization had just been established, with practically all of the world’s leaders embracing free trade with gusto. The dumb mobile phone ruled the day, that too in the hands of less than a quarter of all Americans. And artificial intelligence was just a technical curiosity.

How dramatically today’s world differs from that of 1998. Consider now that, in the next ten years, the world will change more than it has in the last twenty-five. What are the megatrends reshaping the structure and dynamics of the global economy? How will they redefine the organizational features of global enterprises that hope to stay or emerge as the winners in the new era?

Global Game Changers

Among the multitude of forces pulling and pushing the global economy in various directions, we focus on the big five.

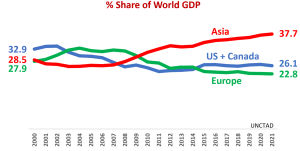

Asia Moves to the World’s Center. In 2000, North America, Europe, and Asia accounted for 90% of the world’s economy, split roughly evenly across the three continents. Today, Asia’s share of the world’s GDP is 38% versus 26% for North America and 22% for Europe. In ten years, Asia’s GDP will likely equal that of the US and Europe combined.

Asia’s economic rise is being fueled by the fact that three of the world’s fastest growing large economic regions are all based in that continent – China, India, and Southeast Asia. Given the slowdown in China, India is now the world’s fastest growing large economy. Currently the fifth largest, it will be the world’s third largest by 2028, according to IMF projections. While the U.S. will remain the world’s dominant economic and technological power for quite some time, the three biggest economies after the U.S. will all be Asian – China, India, and Japan.

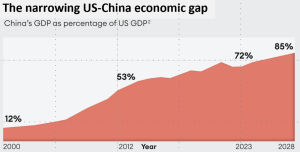

A More Contested World. In 2000, China’s GDP was 12% that of the U.S. Today, it is 72% as large. The gap is closing, albeit much more slowly than in the past. President Xi Jinping has declared that his ambition is to help China supplant America and become the world’s most powerful nation. Given also geopolitical conflicts over Taiwan, South China Sea, and East China Sea, the two countries are now locked in a new Cold War. Backed with clear bipartisan support, the U.S. is engaged in an active economic and technological decoupling from China and is urging its allies to do the same.

Rising tensions between the U.S. and China are not the only geopolitical challenges facing the world. China and India are trapped in a bitter territorial contest over their poorly demarcated 2000-mile border. India and Pakistan have fought multiple wars and remain deadlocked over overlapping claims to Kashmir. North Korea remains a nuclear menace. And, with Russia’s aggression into Ukraine, we are now witness to the first major land war in Europe since WWII.

Crisis of Global Warming. More frequent occurrences of severe weather patterns everywhere are the concrete outcomes of the fact that the earth’s surface temperature has risen by 1.2o C over the last 150 years and could crack an even more dangerous 1.5o C level by 2040. Methane and carbon dioxide emissions are the two biggest culprits. Atmospheric CO2 concentrations have increased from the-then 300 to the-current 420 parts per million over the last century.

Global warming is the toxic side effect of an otherwise glorious development – faster economic growth in emerging economies, which account for 80% of the world’s population and over 40% of the world’s GDP. Until a decade ago, government officials in emerging economies used to argue that dealing with climate crisis was something that only the developed economies needed to worry about. After all, bulk of the CO2 in the atmosphere came from carbon emissions by the developed economies over the last two centuries. The perspective now is different. Citizens in emerging economies suffer as much if not more from severe weather patterns. Unless emerging economies do their part as well, there can be no viable solution to the global problem.

Thankfully, entrepreneurs have responded to the climate crisis with powerful innovations such as solar and wind farms, electric vehicles, battery-based storage systems, and more energy-efficient buildings.

These innovations also have implications for the structure of the global economy. While the world still consumes more oil, gas, and coal each year, the fossil fuel intensity of the global economy is declining. As a direct result, global trade flows will depend less and less on shipments of bulk commodities such as oil, gas, and coal.

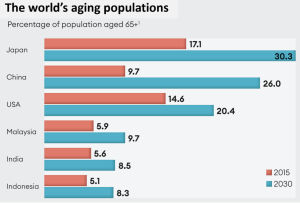

More Gray Hair. The world is aging rapidly. Since 1990, the world’s median age has jumped from 24 to 32. This too is a side effect of rapid economic growth in emerging economies. Irrespective of ethnicity or religious beliefs, when people become better off and more educated, they choose to have fewer children. Rapid aging is most intensely evident in Asia, the world’s fastest-growing economic region. The demographic challenges in China are particularly acute, owing to the disastrous long-term effects of the country’s one child policy. By 2030, 26% of China’s entire population will be 65 years or older in age.

Aging of the population creates several economic challenges. Health care and social security costs increase rapidly. At the same time, the size of the working age population that can help grow the economy shrinks. Unless the elderly agree to delay the minimum retirement age, the only way out for governments is more debt and higher taxes. For developed economies, welcoming more immigrants from emerging economies would certainly help. Immigrants from the future (also called robots) could help as well.

Digitization of Everything. Each passing day, virtually everything is becoming more digitized. Our factories, our business processes, our entertainment, our sports, our work, our meetings, our cars, our highways, our homes, our environment, our watches, our clothes and sneakers, even our bodies.

Digitization of everything, coupled with decline in commodities trade and shorter supply chains for manufactured goods, means that globalization – i.e., cross-border integration among nations – is increasingly being defined by flows of bits and bytes rather than atoms. According to McKinsey, cross-border data flows are growing by 20% each year and already account for a bigger contribution to global GDP than trade in physical goods.

Strategic Implications for Global Companies

Evolutionary theory tells us that, when the environment changes, organisms need to change as well. Otherwise, they wither and die. The outlines of what the above-discussed megatrends means for global enterprises are already becoming clear.

Deepen Your Engagement with Local Ecosystems. Global scale remains important for global competitive advantage. As emerging economies scale up, no company – low-tech or high-tech – can hope to acquire the necessary scale without a deep commitment to win not just in developed but also in emerging markets.

Winning in large and intensely competitive markets is rarely possible without a deep commitment to and engagement with the local ecosystem, including the localization of a good chunk of the value chain. American companies discovered this early on in their battle for European and Japanese markets (and vice versa). This imperative is now becoming true for emerging markets as well. This is why Tesla has a giga factory in Shanghai, is building one in Mexico, and has signaled that its next giga factory after that could be in India.

Deeper engagement with local markets will require deeper market penetration in both urban as well as rural markets, localization of products and services, localization of production, much greater reliance on local talent, openness to local alliances, and deeper engagement with local stakeholders such as the media and the government.

Over time, these developments will mean that the global enterprise becomes more a federation of regional hubs than a centrally run monolith. As Enrique Lores, HP’s chief executive, remarked in a recent interview, “We’re going to go to a model that is going to be much more regional where there will be regional hubs both for manufacturing and, to some extent, design.”

De-Risk Your Global Supply Chain. Growing geopolitical tensions mean that pure efficiency can no longer be the sole driver of how global supply chains are designed. Companies also need to factor in risks of disruption from government mandates or actual conflict. Depending on the product, the path to de-risking lies in an optimal combination of friend-shoring, near-shoring, and in-shoring.

As an example, take Apple which has historically concentrated the assembly of virtually all products in China. Working with manufacturing partners such as Foxconn, Apple is steadily but rapidly developing new global manufacturing hubs in India and Vietnam. Over the last one year, India’s share of global iPhone production has grown from 2% to 7%. According to media reports, it is expected to hit 25% by 2025. Similarly, Apple has started diversifying the production of MacBooks from China to Vietnam.

Sustainability as a Core Plank in Your Strategy. Insurers are already starting to price in climate risks faced by companies. So are investors. The risks of ignoring environmental sustainability can only increase over time. Thus, companies must make sustainability an imperative in the design and management of every activity in the value chain – manufacturing, supply chain logistics, even office buildings. We are particularly impressed with Unilever’s efforts – what the company calls its “Sustainable Living Plan” – in this regard.

Given the growing awareness of the climate crisis among consumers, sustainability is also becoming an opportunity to increase the competitive advantage of the company’s products and services. Not surprisingly, in 2018, Unilever launched OMO EcoActive, a laundry detergent, designed to deliver excellent cleaning performance while using less water and energy.

Look for the Gold in the Gray. Aging of the population, while an economic challenge at the social level, also presents opportunities for companies. With the elderly accounting for a bigger proportion of the population, the demand for products and services that cater to their needs can be expected to grow at a faster pace than the overall economy. Pharma, retirement homes, in-home healthcare, robotic assistants, and wealth management are some of the industry sectors that should be beneficiaries of the demographic changes under way.

A New China Strategy: In-China-for-China. Companies with an already sizable market presence in China need to start compartmentalizing their China business from the rest of the global operations. Such a strategy would help the company stay committed to China while reducing the risks from potential adverse regulatory mandates from either China or the home country. A recent survey of 480 member companies by the EU Chamber of Commerce in China found that 27% of them had already started decoupling the Chinese operations from corporate headquarters.

Consider the German carmaker Volkswagen. Starting in 2022, VW has invested over $2 billion in a partnership with Horizon Robotics, a Chinese software and chip maker focused on autonomous driving. According to a company statement, any technology developed by the joint venture will stay in China.

Optimize the Management of Digital Assets. As we discussed earlier, for every company, the business value of digital assets is growing much faster than that of physical assets. Digital assets include software, digital platforms, product and process blueprints, data, and AI algorithms. For the global enterprise, creating and managing digital assets requires paying attention to a number of questions.

Organizations maximize their chances of survival when they mirror or adapt to changes in the external environment. The structure and dynamics of the global economy in 2030 will be dramatically different from those in 2010 or even 2020. Global enterprises that hope to stay or emerge as the winners in the new era must rethink and redesign almost all key aspects of their strategies and organizations. As the legendary ice hockey champion Wayne Gretzky exhorted, “Skate to where the puck is going, not where it has been.”

Thinkers50 Limited

The Studio

Highfield Lane

Wargrave RG10 8PZ

United Kingdom

Thinkers50 Limited

The Studio

Highfield Lane

Wargrave RG10 8PZ

United Kingdom

Thinkers50 Limited

The Studio

Highfield Lane

Wargrave RG10 8PZ

United Kingdom

| Cookie | Duration | Description |

|---|---|---|

| LANG | 9 hours | Linkedin set this cookie to set user's preferred language. |

| nsid | session | This cookie is set by the provider PayPal to enable the PayPal payment service in the website. |

| sp_landing | 1 day | The sp_landing is set by Spotify to implement audio content from Spotify on the website and also registers information on user interaction related to the audio content. |

| sp_t | 1 year | The sp_t cookie is set by Spotify to implement audio content from Spotify on the website and also registers information on user interaction related to the audio content. |

| tsrce | 3 days | PayPal sets this cookie to enable the PayPal payment service in the website. |

| x-pp-s | session | PayPal sets this cookie to process payments on the site. |

| __cf_bm | 30 minutes | This cookie, set by Cloudflare, is used to support Cloudflare Bot Management. |

| Cookie | Duration | Description |

|---|---|---|

| l7_az | 30 minutes | This cookie is necessary for the PayPal login-function on the website. |

| Cookie | Duration | Description |

|---|---|---|

| CONSENT | 2 years | YouTube sets this cookie via embedded youtube-videos and registers anonymous statistical data. |

| _ga | 2 years | The _ga cookie, installed by Google Analytics, calculates visitor, session and campaign data and also keeps track of site usage for the site's analytics report. The cookie stores information anonymously and assigns a randomly generated number to recognize unique visitors. |

| _gat_gtag_UA_10408481_1 | 1 minute | Set by Google to distinguish users. |

| _ga_ZP8HQ8RZXS | 2 years | This cookie is installed by Google Analytics. |

| _gid | 1 day | Installed by Google Analytics, _gid cookie stores information on how visitors use a website, while also creating an analytics report of the website's performance. Some of the data that are collected include the number of visitors, their source, and the pages they visit anonymously. |

| Cookie | Duration | Description |

|---|---|---|

| NID | 6 months | NID cookie, set by Google, is used for advertising purposes; to limit the number of times the user sees an ad, to mute unwanted ads, and to measure the effectiveness of ads. |

| test_cookie | 15 minutes | The test_cookie is set by doubleclick.net and is used to determine if the user's browser supports cookies. |

| VISITOR_INFO1_LIVE | 5 months 27 days | A cookie set by YouTube to measure bandwidth that determines whether the user gets the new or old player interface. |

| YSC | session | YSC cookie is set by Youtube and is used to track the views of embedded videos on Youtube pages. |

| yt-remote-connected-devices | never | YouTube sets this cookie to store the video preferences of the user using embedded YouTube video. |

| yt-remote-device-id | never | YouTube sets this cookie to store the video preferences of the user using embedded YouTube video. |

| yt.innertube::nextId | never | This cookie, set by YouTube, registers a unique ID to store data on what videos from YouTube the user has seen. |

| yt.innertube::requests | never | This cookie, set by YouTube, registers a unique ID to store data on what videos from YouTube the user has seen. |

| Cookie | Duration | Description |

|---|---|---|

| DEVICE_INFO | 5 months 27 days | No description |

| loglevel | never | No description available. |

| m | 2 years | No description available. |

Thinkers50 Limited has updated its Privacy Policy on 28 March 2024 with several amendments and additions to the previous version, to fully incorporate to the text information required by current applicable date protection regulation. Processing of the personal data of Thinkers50’s customers, potential customers and other stakeholders has not been changed essentially, but the texts have been clarified and amended to give more detailed information of the processing activities.